Pre-Event Survey: Aligning Interests in Support of Chemistry Research

As part of an NSF-sponsored workshop on Aligning Interests in Support of Chemistry Research, UIDP surveyed corporate members to determine their company’s interest in and experience with university research that is jointly funded by government and industry. The survey consisted of nine questions, one of which was industry sector-related, five with set responses, and three open-ended questions. There were 22 total respondents, 14 of which are participating in the above-mentioned workshop. Download the full survey report.

Investment and Interest in Collaborative Research: The respondent pool is highly invested in academic research, with 91% of the respondents currently making measurable investments in academic research and a similar percentage currently participating in government-sponsored grants. Of those not participating in government-sponsored research, the remainder have participated in such projects in the past. Similarly, 95% of respondents were interested in collaborative research with other companies and 85% were interested in partnering with government agencies to co-invest in academic research.

Barriers to seeking government grants: Survey respondents were asked to rank-order the most significant barriers when seeking government grants with academic partners. For the total respondent pool, IP was the top issue, with time and resource commitment ranking second. Difficulty selling proposals to senior management and long timelines from application to funding were essentially tied as the next most significant issues. For the respondents who are participating in the workshop, the lack of relevance was a top issue and difficulty selling management was a lower priority.

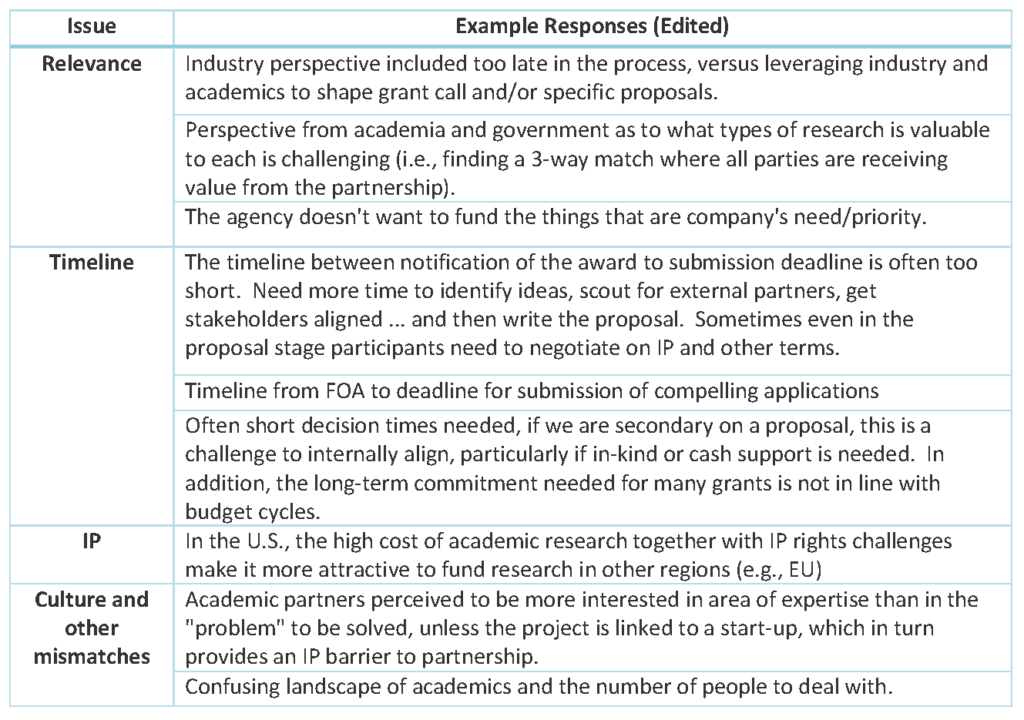

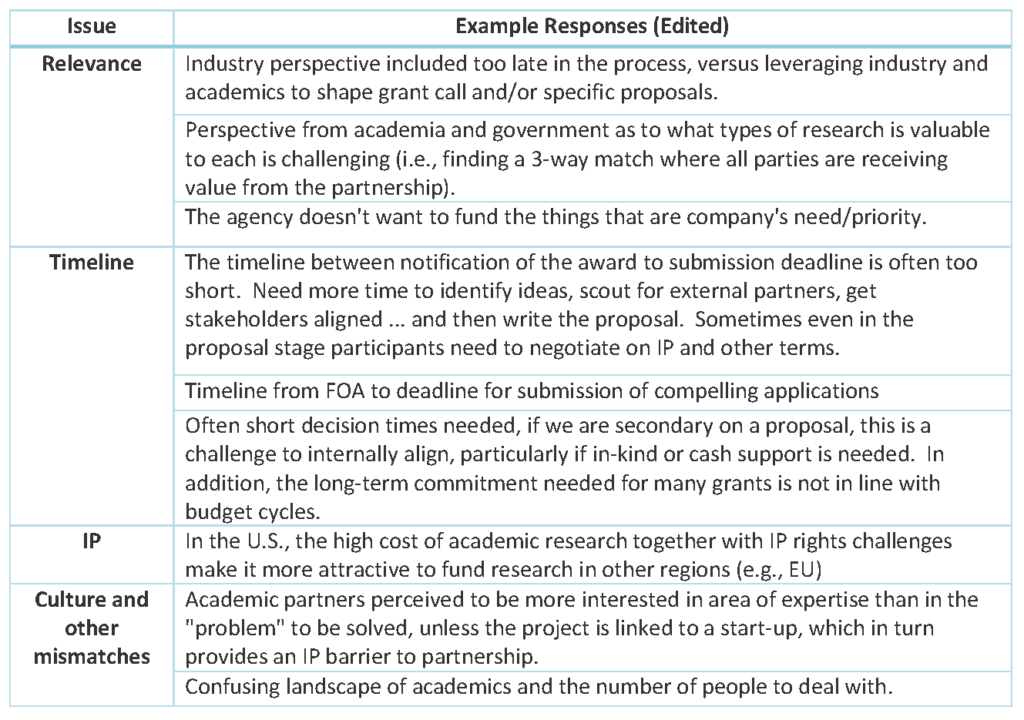

Additional Barriers: An open-ended question was asked seeking additional barriers not covered in the above selections. Among the issues mentioned were late involvement in seeking an industry perspective, IP issues which make working in other regions more attractive, relevance and timeline issues. The full list of issues is given below.

Additional Barriers: An open-ended question was asked seeking additional barriers not covered in the above selections. Among the issues mentioned were late involvement in seeking an industry perspective, IP issues which make working in other regions more attractive, relevance and timeline issues. The full list of issues is given below.

Specific Experience with Government Funding: In another open-ended question, respondents were asked to share experiences (both positive and negative) with government funding. Among the areas mentioned were:

Specific Experience with Government Funding: In another open-ended question, respondents were asked to share experiences (both positive and negative) with government funding. Among the areas mentioned were:

- Positive experience with NSF IUCRC for early precompetitive research;

- Positive experience with NSF GOALI but sometimes these programs lack faculty enthusiasm;

- Complexity of multi-party IP negotiations and associated time pressures associated with completing these agreements within the proposal timeline;

- The need for a sufficient ROI (meaning access to IP) to justify investment in joint R&D;

- Positive experience with national labs and NIST for enabling capabilities such as measurement or computing power needed to advance a field of research; and

- Problems with NSF SBIR reviews due to lack of relevance, inconsistency, and lack of feedback on proposals.

Areas for Possible Funding: Associated with the above-mentioned workshop, survey respondents were asked for suggested focus areas for government support of industry-university research partnerships. Fifteen (15) suggested research ideas were proposed that could be categorized into five thematic areas.

- General issues around sustainability;

- Measurement and predictive tools;

- Low carbon technologies and plastic use/recycle;

- Impact of climate change on business and technologies; and

- Research and collaboration methods.

This full list of proposed areas, along with other participant-proposed ideas, will be reviewed in the upcoming NSF workshop and summarized in the final workshop report.

About the respondent pool: As would be expected from the survey topic, the respondent pool is highly tilted toward companies in the chemical sciences, as shown in the attached table.