UIDP Projects Survey | Forecast: Anticipated Investment in Academic Engagement

Will investments in university-industry research accelerate as we enter a new academic year? Will economic factors like inflation affect investments? For the third year, UIDP took the industry pulse on anticipated academic engagement and plans for expanding partnerships or maintaining the status quo. Download the survey report.

The most recent market scan was in the field for a week and received 12 responses. When applicable, responses for identical questions are compared to results from prior years.

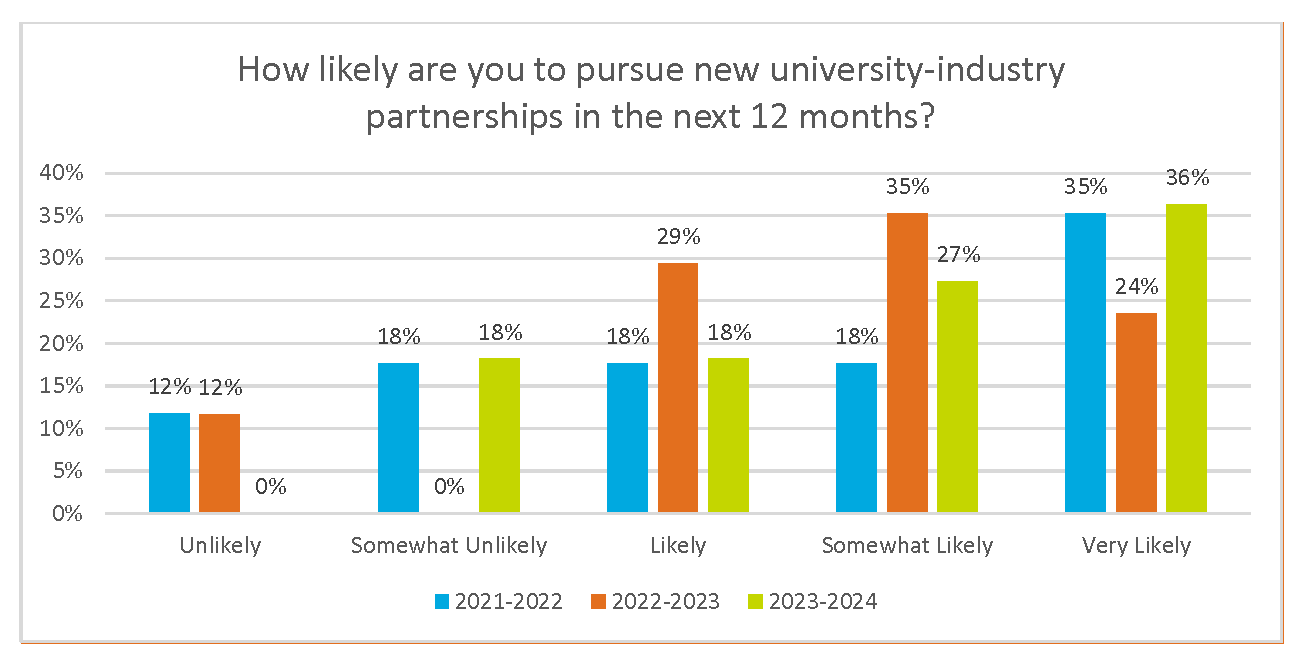

When asked about the likelihood companies will pursue new university-industry partnerships in the next 12 months, a majority of respondents (81%) indicated that they were likely to very likely to pursue new U-I partnerships this year, with 36% saying they were very likely, a 12% increase over last year’s response. This is a slight drop from last year’s response (88% likely to very likely), but for the first time, no respondents indicated that they would be entirely unlikely to pursue new partnerships.

When asked about the likelihood companies will pursue new university-industry partnerships in the next 12 months, a majority of respondents (81%) indicated that they were likely to very likely to pursue new U-I partnerships this year, with 36% saying they were very likely, a 12% increase over last year’s response. This is a slight drop from last year’s response (88% likely to very likely), but for the first time, no respondents indicated that they would be entirely unlikely to pursue new partnerships.

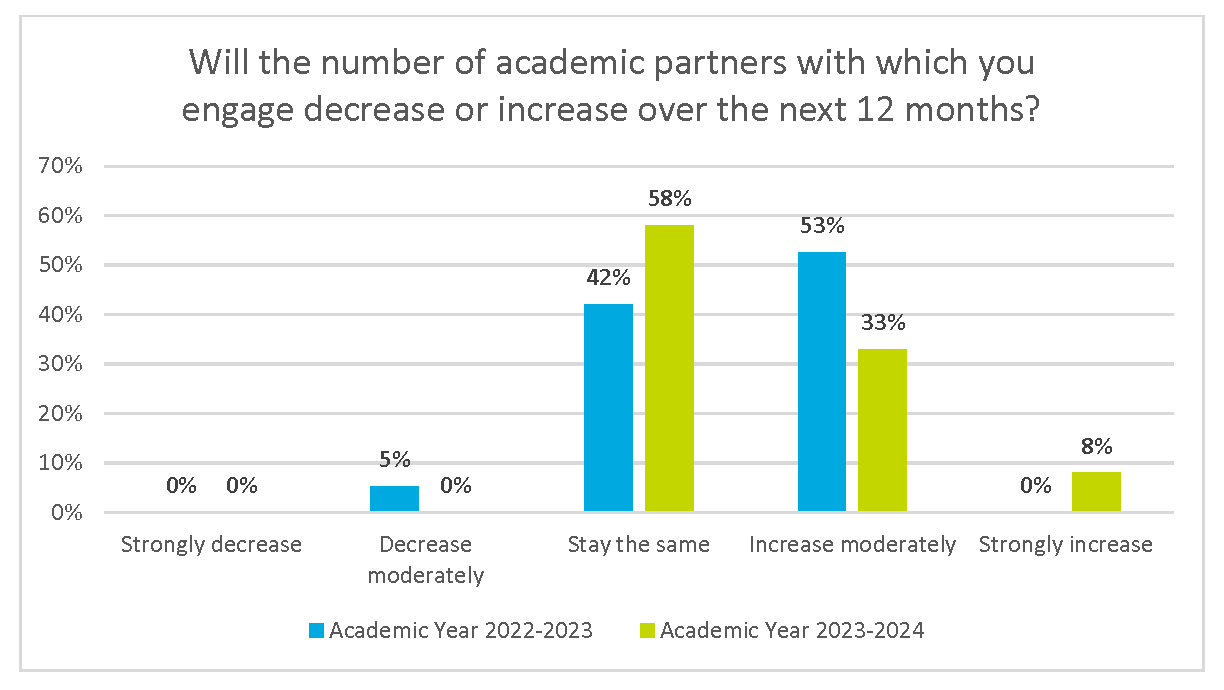

Despite this openness to new partners, most participants (58%) indicated that their total number of partners would remain the same over the next academic year. The proportion of those who said they anticipated having more partnerships dropped to 41% (compared to 53% of respondents last year). However, no respondents indicated that the number of academic partners would decrease this year, and 8% indicated that their number of partners would strongly increase.*

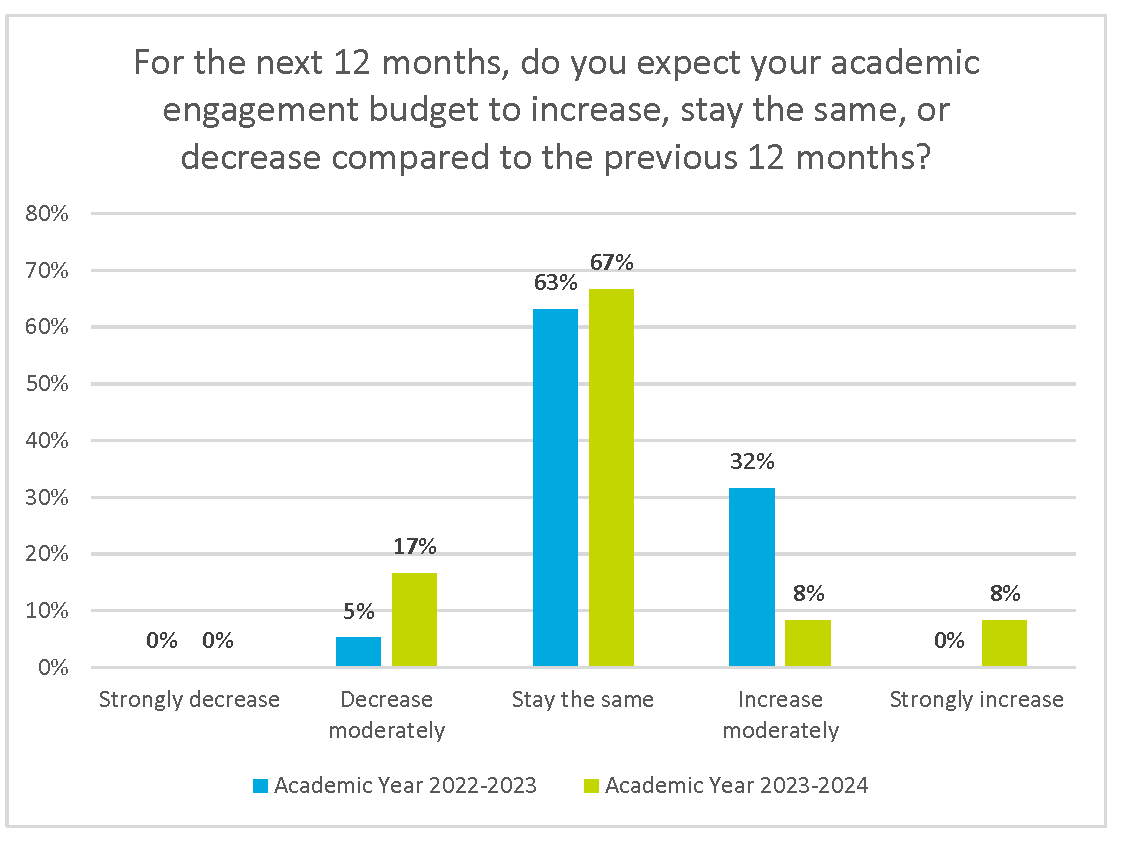

Respondents were also asked whether their academic engagement budget would decrease, stay the same, or increase. While most respondents this year indicated that their budgets would likely remain the same, there was a significant drop from those who expected their budgets to increase, from 32% last year to only 16% this year. Those who expected moderately decreased budgets rose from 5% to 17% this year. No respondents indicated a strong decrease in academic engagement budget in either of the years the question was included in the survey.* In a follow-up question to ask whether rising inflation is a factor in budgeting for sponsored research, half of the respondents said it would have a moderate impact, but the company was sticking to about the same number of projects and institutions; 42% said it would have no impact on investments and only 8% said they had plans to reduce the number of sponsored projects because of significant impact.

Respondents were also asked whether their academic engagement budget would decrease, stay the same, or increase. While most respondents this year indicated that their budgets would likely remain the same, there was a significant drop from those who expected their budgets to increase, from 32% last year to only 16% this year. Those who expected moderately decreased budgets rose from 5% to 17% this year. No respondents indicated a strong decrease in academic engagement budget in either of the years the question was included in the survey.* In a follow-up question to ask whether rising inflation is a factor in budgeting for sponsored research, half of the respondents said it would have a moderate impact, but the company was sticking to about the same number of projects and institutions; 42% said it would have no impact on investments and only 8% said they had plans to reduce the number of sponsored projects because of significant impact.

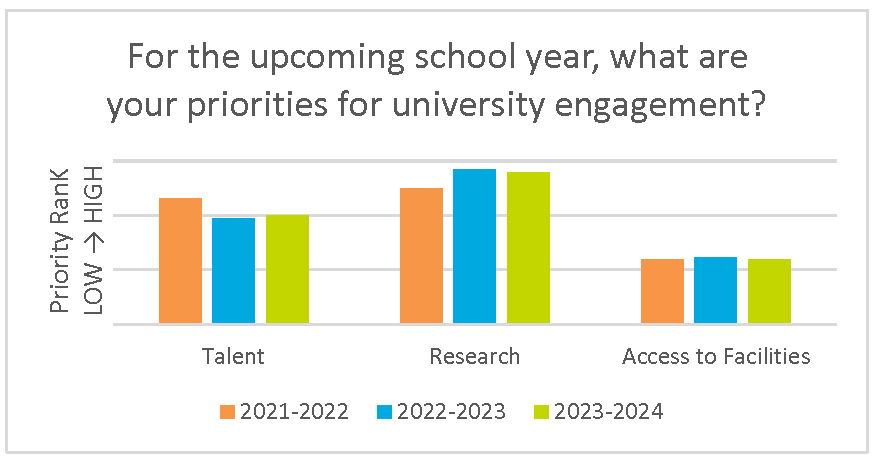

UIDP also polled priorities for the upcoming academic year, asking respondents to rank each priority on a scale from 0 to 3, with three the highest priority. Responses remained nearly identical over all three years of the survey, with research ranked highest, followed by talent and then access to facilities. UIDP also polled priorities for the upcoming academic year, asking respondents to rank each priority on a scale from 0 to 3, with three the highest priority. Responses remained nearly identical over all three years of the survey, with research ranked highest, followed by talent and then access to facilities.

UIDP also polled priorities for the upcoming academic year, asking respondents to rank each priority on a scale from 0 to 3, with three the highest priority. Responses remained nearly identical over all three years of the survey, with research ranked highest, followed by talent and then access to facilities. UIDP also polled priorities for the upcoming academic year, asking respondents to rank each priority on a scale from 0 to 3, with three the highest priority. Responses remained nearly identical over all three years of the survey, with research ranked highest, followed by talent and then access to facilities.

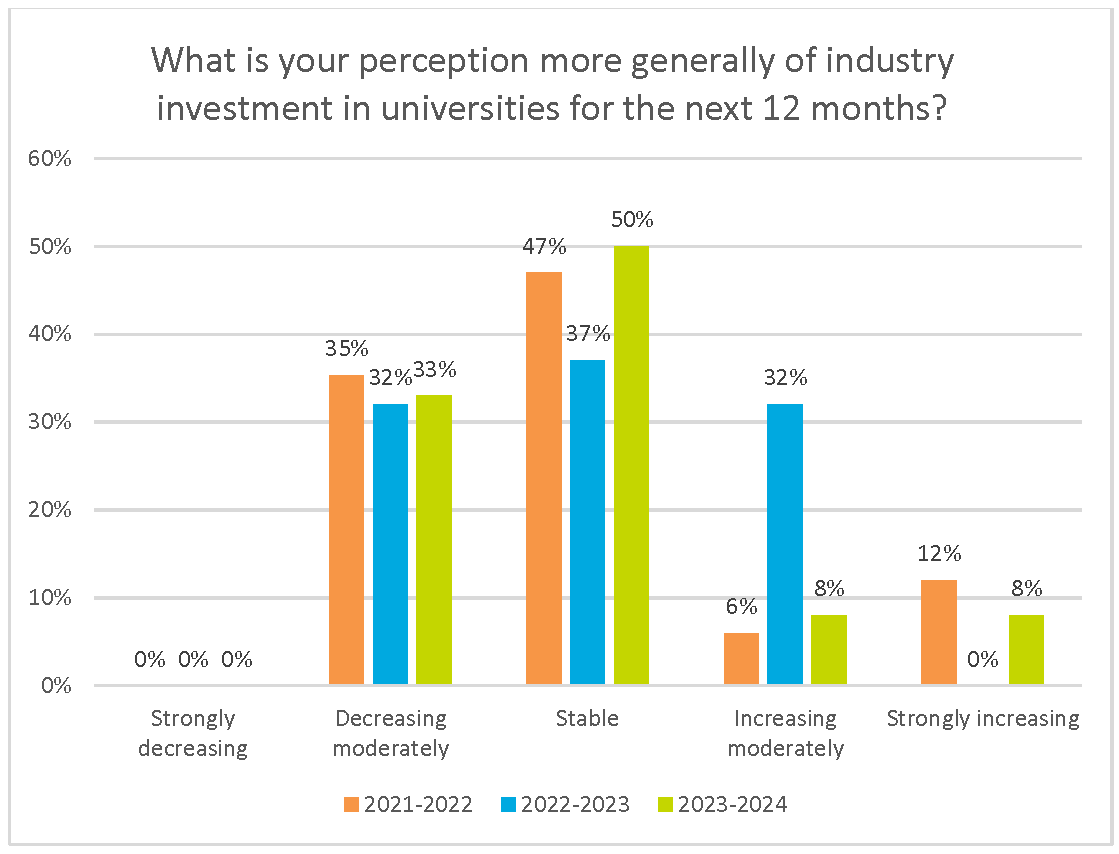

Finally, UIDP asked respondents to indicate their perception of industry investment in universities over the next 12 months. Half of this year’s respondents indicated that industry investment in universities was stable, while 33% said it was decreasing moderately, and 16% indicated it was increasing either moderately or strongly.

There is a significant change in this year’s response from last year’s—a shift toward perceptions much closer to those in 2021-2022. For the 2022-2023 survey, respondents were closely split as to whether investment was moderately increasing, moderately decreasing, or stable (32%, 37%, and 32%, respectively), but a large proportion (32%) were optimistic that investment was increasing moderately. Only 16% of respondents see investment increasing this year, compared to 32% last year.

*This question was not included in the 2021-2022 survey.